This consultation has concluded

Detail of outcome

Under the Defence Reform Act 2014 (the Act), the Single Source Regulations Office (SSRO) is required annually to review the baseline profit rate, capital servicing rate and SSRO funding adjustment used to determine the contract profit rate for pricing qualifying defence contracts (QDCs) and qualifying subcontracts (QSCs). Section 19(2) of the Act requires the SSRO to provide the Secretary of State with its assessment of the appropriate rates for each year.

The consultation proposed changes to specific aspects of the activity, company size and data quality criteria used to select companies in the assessment of the baseline profit rate.

We received eight responses to the consultation, which we have considered in finalising the changes to the methodology. The summary of consultation responses available above explains how the feedback provided by stakeholders has informed the final methodology. The revised methodology document available above explains the methodology that the SSRO will apply in making its assessment of the rates that should apply for 2020/21.

Most respondents identified aspects of the SSRO’s methodology they considered we should prioritise for review in the future and this feedback is summarised in the consultation response document. We will be engaging with stakeholders on topics to take forward as priorities for a future corporate plan in the coming months.

Original consultation

Summary

Consultation description

Section 19(2) of the Defence Reform Act 2014 requires that the Single Source Regulations Office (SSRO) provides the Secretary of State with its assessment of the appropriate baseline profit rate, capital servicing rates, and SSRO funding adjustment (“rates”) by 31 January each year for the purpose of assisting the Secretary of State in determining what those rates are for the subsequent financial year.

The SSRO is consulting on changes to the way it undertakes the assessment of the baseline profit rate. The current approach is set out in its Single Source Baseline Profit Rate, Capital Servicing Rates and Funding Adjustment Methodology.

The SSRO, in discussion with stakeholders, prioritised detailed work in 2019/20 to further refine this methodology by reviewing the activity, company size and data quality criteria used to select companies used to benchmark profits. The outcome of that work is reflected in the proposals contained in this consultation.

This consultation is open to anyone with an interest in ensuring that good value for money is obtained in government expenditure on Qualifying Defence Contracts (QDCs) and Qualifying Subcontracts (QSCs) and that the prices paid under these contracts are fair and reasonable. We particularly welcome comments from individuals or organisations with an interest in non-competitive defence procurement.

The consultation runs until 26 August 2019. A consultation response form is available. Completed response forms should be sent: a) by email to consultations@ssro.gov.uk (preferred); or b) by post to SSRO, Finlaison House, 15-17 Furnival Street, London, EC4A 1AB.

The SSRO also welcomes the opportunity to meet with stakeholders to discuss the proposals during the consultation period. If you wish to arrange such a meeting, please contact us at the earliest opportunity via consultations@ssro.gov.uk.

Summary of consultation responses

Updated 3 October 2019

1. Introduction

Background

1.1 Section 19(2) of the Defence Reform Act 2014 (the Act) requires that the Single Source Regulations Office (SSRO) provides the Secretary of State with its assessment of the appropriate baseline profit rate, capital servicing rates, and SSRO funding adjustment (“rates”) by 31 January each year for the purpose of assisting the Secretary of State in determining what those rates are for the subsequent financial year.

1.2 The SSRO’s approach to calculating its assessment is set out in its Single Source Baseline Profit Rate, Capital Servicing Rates and Funding Adjustment Methodology (“the methodology”). . 1.3 Following engagement with key stakeholders during summer 2018, the SSRO conducted an eight-week public consultation[footnote 1]on proposed changes to the methodology in three areas to:

a. remove ‘small’ companies from the result by introducing a more sophisticated companysize criteria, aligned to those used by other organisations, to further improve stability of the comparator group and to enhance the objectivity of that aspect of the methodology;

b. calibrate the automatic filters that identify a company’s activities to further reduce the need for manual intervention; and

c. clarify or codify existing practice in the activity characterisations to provide additional transparency and give further assurance that the methodology is applied in a consistent way.

Consultation summary

1.4 During the consultation period, the SSRO:

a. held group and individual discussions with members of the SSRO’s Operational Working Group[footnote 2] (OWG) and other interested parties;

b. received 8 responses to the consultation.

1.5 The SSRO would like to take this opportunity to thank those who responded to the consultation for sharing their views with us. 5 respondents gave permission for their responses to be published and these are available in SSRO (2019) Single source baseline profit rate methodology: Consultation Responses.

1.6 Overall, consultation respondents welcomed the opportunity to engage with the SSRO on the methodology. Most respondents expressed some support that the proposed changes improve the methodology; however, in all cases, industry respondents consider that the changes do not adequately address the topic areas, and some challenged the validity of the methodology in its entirety. These positions are largely based on arguments that have previously been put to the SSRO and that we have responded to. Having taken into account the representations made, the SSRO are of the view that the methodology is appropriate and the only changes at this time should be those that were consulted on.

1.7 We acknowledge that industry respondents have raised specific feedback on some technical aspects of the methodology that were outside the scope of the consultation and these are set out in Section 3. The SSRO is always open to constructive discussion on incremental improvement to the way in which it applies transfer pricing principles upon which the methodology is based. We will put any such matters forward for consideration in future work programmes.

1.8 As a result of feedback, we will alter the description of the geography search criteria for clarity, but this does not alter the substance of the change to the methodology. The other changes that were consulted on will be implemented as proposed.

1.9 The following sections of this paper summarise the views and evidence provided by consultation respondents, together with the SSRO’s commentary on how these responses have informed the final methodology in the areas on which we consulted.

1.10 The methodology will be applied by the SSRO in assessing the rates it will recommend to the Secretary of State that should apply from 1 April 2020.

2. Search criteria and activity characterisations

2.1 The MOD supported the proposed changes; we have set out below a summary of the key points made by other respondents with regards to the proposed changes to the methodology relating to the search criteria and activity characterisations.

2.2 Most respondents also gave comments on other aspects of the methodology or on other matters out of scope of the methodology and these are discussed in Section 3

Geography criteria

2.3 One respondent sought clarity on the meaning of the term ‘overseas territories’ in paragraph 3.30 of the consultation, since certain UK overseas interests are determined to be British Overseas Territories.

2.4 The exclusion of overseas territories means that only the part of the political definition of a country that is geographically located in Western Europe and North America would be included. For example, French Guiana would not be included as part of “France” for the purposes of the search. We accept this could be better phrased and propose to alter the text consulted on as follows:

9.11 Companies located in the following geographical regions, not including overseas territories, are included in the search: – Western Europe – North America

Company size criteria

General views on proposed changes

2.5 Four industry respondents considered that the proposed changes improve the methodology; however, they also consider that there are wider issues with the methodology that need to be addressed to ensure it meets its objectives (see section 3). This view is shared with three other respondents to the consultation.

2.6 SSRO response: We will implement the proposed changes to the methodology. Comments and feedback on further changes will be logged and put forward for consideration in future work programmes.

Comparison with single source MOD contractors

2.7 Some industry respondents proposed a more extensive consideration of comparability. They considered that companies performing QDCs and QSCs perform additional economic activities associated with integrating sophisticated equipment into complex systems that were absent in comparator group companies.

2.8 Some respondents considered that the economic activities performed by MOD’s contractors were generally to higher or more complex standards than those performed by comparator group companies. They argued that the work performed under QDCs/QSCs is usually more specialised, complex and risky.

2.9 Five industry respondents were of the view that it would not be typical for a company with a turnover £10.2 million and total assets of £5 million and/or 50 employees to possess the required resources to prequalify for any MOD tender and a typical company the MOD engages with is much larger and is capable of managing greater complexity than the existing, or proposed size thresholds. They pointed to the SSRO’s own analysis presented in the consultation document that showed most QDC contractors to be “Large” or “Very Large” and one respondent noted that the SSRO’s 2018/19 Annual Statistics shows that there were only 11 out of 201 contracts that were contracted to SMEs. One respondent suggested that the turnover threshold should be set at the level of not less than £50 million, to match the threshold that gives the same availability of data as in the US. One respondent noted it had gathered information that the comparator group did consist of companies whose economic activities were included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs, but that some relevant activities were absent.

2.10 SSRO’s response: We have considered the matters raised by respondents, but do not agree these undermine the validity of the comparator group. The definition of comparability that the SSRO applies is that a company must undertake economic activities that are included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs. We consider that this definition reflects a robust and operable application of the OECD transfer pricing guidelines. We welcome the acknowledgement that the comparator companies meet the requirements of the definition. Given the representation in the comparator group of the MOD’s major single source contractors and of the defence industry more broadly, it is not the case that certain relevant activities are absent from comparator companies, although clearly not all comparators (or all QDC holders) would be capable of performing the entirety of the largest or most complex QDCs. Whether activities are contracted for on a basis that would meet the legal threshold for classification as a QDC or QSC or the MOD’s contracting policies is not in our view a categorical determinant of whether a company undertakes comparable activities.

Relationship between turnover and profitability

2.11 One industry respondent noted that their own analysis showed a relationship between turnover and profitability. Another told us that the data produced by the Government Profit Formula process (Yellow Book) always showed a relationship.

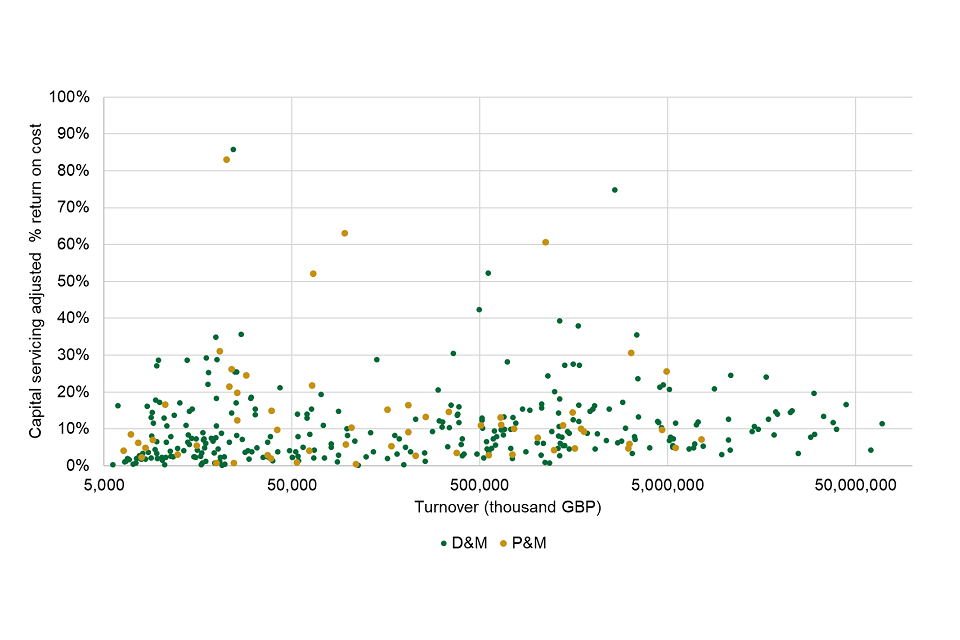

2.12 SSRO response: The SSRO’s own analysis on the actual comparator companies used to assess the baseline profit rate do not show a systematic relationship between return on cost of production and turnover (see chart 1 and chart 2). The SSRO has reviewed the analysis referred to by industry that has been made available, and does not believe it demonstrates otherwise. In particular, the analysis did not reflect important improvements the SSRO has made to the methodology in response to industry feedback. We can see no clear economic rationale as to why in a competitive market a company’s profit rate would be systematically determined by its size and such a relationship is not borne out in the data.

Chart 1: relationship between profit and turnover BPR comparator group 2019/20

Availability of data for assessing impact of criteria changes

2.13 One industry respondent did not believe that sufficient data was made available to make an assessment on changing the criteria for the threshold. They identified the key missing data to be that which would enable the assessment of the affect the proposed changes would have on the baseline profit in previous years.

2.14 SSRO response: The SSRO considers it has provided appropriate transparency of data in both written form and at workshops to enable an informed assessment of the merits or otherwise of changing the criteria. Developments in the SSRO’s methodology are intended to incrementally improve the way in which it applies the OECD transfer pricing guidance and are not designed with a specific numerical outcome in mind. We consider that changes should be made on their own merits rather than on the outcome they might deliver.

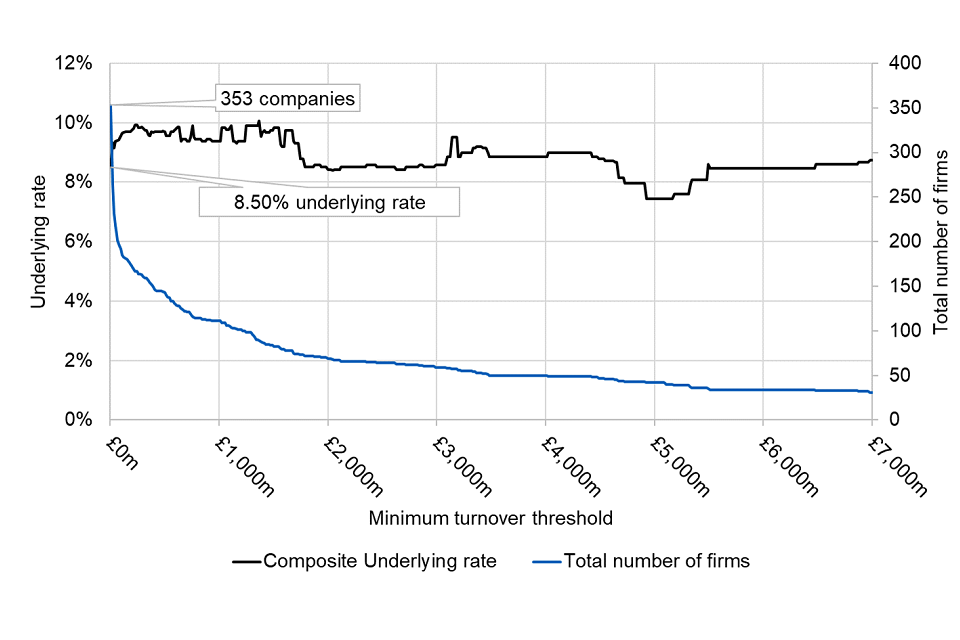

2.15 The BPR is set with reference to actual returns generated by profitable comparator companies and is therefore responsive to changes in the underlying performance of those comparator companies and could increase, decrease or stay constant. However, had the new company size criteria been applied for the 2019/20 rates assessment and all other considerations remained unchanged, the result of the methodology would have been a BPR of 7.86% (compared to 7.63%).

2.16 For completeness we include the underlying comparator group profit rates for the full range of turnover criteria as presented to the Operational Working Group.

Chart 2: impact of increasing the turnover threshold on the underlying rate of the 2019/20 comparator group

Financial criteria

2.17 Two industry respondents commented on the proposed tangible fixed asset criteria. One proposed that the criteria should also consider intangible fixed assets and assets that are not recognised on the balance sheet, and those that have been fully written down and old book values. The second suggested the measure should be limited to UK based fixed assets so that it ensures that tangible fixed assets are held within the relevant economy.

2.18 SSRO response: The SSRO uses data that is published and collated in Orbis and therefore cannot filter based on assets not recognised in the balance sheet. The SSRO considered using the existence of “intangible assets” as a search criteria but found that some companies carry out comparable activities despite not having intangible assets on their balance sheet. As noted by respondents, intangible assets are often not recognised on a company’s balance sheet. Further analysis would need to be undertaken in order to persuade the SSRO that this is a reliable criteria to apply.

Activity type NACE Rev 2 codes and text search terms

2.19 One industry respondent said that they do not believe that industry have agreed the NACE codes currently utilised in the selection of the comparator set. They suggested that the current NACE codes do not identify enough companies that undertake prime contracting of complex platforms and integration of many complex systems and that this results in a comparator group comprising of equipment suppliers and not prime contractors.

2.20 SSRO response: The defence industry as well as other complex systems integrators are well represented in the comparator group. We welcome submissions of specific companies, not present in the comparator groups, for assessment against the criteria for inclusion. In 2016, the SSRO consulted on its methodology and NACE codes were a subject of that consultation. This consultation also considered the NACE codes used and updated them based on the responses received. We remain open to future suggestions of particular codes we should consider for inclusion or removal.

Specific queries about detailed aspects of the proposals

2.21 Responses to the consultations included some specific queries or comments about aspects of the proposals. These are set out in the table below with references to the paragraphs in question in the original consultation document.

Table 1: Specific issues identified by consultation respondents

| Comments | Response |

|---|---|

| Para 3.10: One respondent thought the consideration of criteria applicable to R&D tax credits may be irrelevant as it is the MOD’s declared policy to reclaim R&D credits regardless of their purpose. | The SSRO did not intend to make any comment on the extent to which R&D tax credits are an Allowable Cost. |

| Para 3.14: Two industry respondents questioned the relevance of including the ex-hire sector. One found that the proposed new words confusing, and the other proposes that they should not be incorporated into the description because they consider that the nature of hire businesses and the services they provide has no comparison with many companies that perform single source contracts. | The SSRO consider that hiring and leasing of assets is an activity that it is relevant to include to the activity characterisations. |

| Para 3.25: One industry respondent disagreed with the proposal to exclude high value services with high margins (i.e. professional services like accountancy and legal advice) from the comparator group. They argued that such exclusion would set an artificial limit which does not reflect the real market. | The Ancillary Services activity group, which is the subject of these comments, is not incorporated into the baseline profit rate assessment. It is produced for information and is specifically intended to exclude higher value-adding services. The SSRO is open to considering entirely new, or modified versions of existing comparator groups which may include such activities. |

| Para 3.26-3.27: One respondent proposed the methodology should consider how global companies which generate significant revenues outside of Western Europe/North America, particularly in the Middle East are treated. | The SSRO considers that the methodology is clear that the comparable activities of the business are expected to meet the relevant activity characterisation and be undertaken in comparable geographic areas. These comparable geographic areas would typically include Western Europe and North America. |

| One industry respondent agreed with the proposed change to delete text referring to pumps, actuators and motors (para 3.9) because they are not sufficiently complex to be included in the comparator group. | The SSRO will implement the proposed change. |

| Para 3.30-31: One respondent sought clarity on whether the proposal aims to eliminate the overseas subsidiaries of UK based GUO as well. | No, the data used is consolidated financial data of the Global ultimate owner (GUO) of a corporate group, as reported by the company. |

| Para. 3.30-31: One respondent sought clarity on whether the criteria has consideration of companies that register outside of Western Europe and North America for tax purposes, but predominantly operate in those areas. | The criteria requires that companies are registered in North America or Western Europe, and therefore excludes companies incorporated outside of those jurisdiction. |

| Para. 3.32-34: One respondent questioned why “Retail” and “Wholesale” companies only tend to be excluded rather than be excluded in all cases. | The SSRO would expect all such companies to be rejected, however we consider it good practice to validate any such decision as correct as a company may have been inappropriately classified. |

| Para 3.38: One industry respondent sought clarity on what “or similar” meant in the phrase “the word military (or similar)”. | For clarity, using an asterisk in the search term “militar*” means that it will include all words starting with those letters, for example “military” “militarised”, militarized”, etc. |

| One industry respondent sought assurance that subsidiary undertakings were excluded from the comparator groups. | The exclusion of subsidiary undertakings is covered by 9.8 to 9.10 of the current methodology and we are not proposing to alter this. |

3. Other changes and future review

Other feedback from the consultation

3.1 The respondents were asked to identify any material issues in the topic areas covered in the consultation that they believed have not been adequately addressed in the proposed changes. We also invited respondents to identify whether there were any aspects of the SSRO’s methodology that we should prioritise for review in the future.

3.2 The feedback is summarised in the table below, alongside the SSRO’s responses. We will be engaging with stakeholders on topics to take forward as priorities for a future corporate plan in the coming months.

Detailed responses

The consultation set out three specific “yes/no/don’t know” questions for respondents on the proposed change, to which only five of the eight respondents provided answers. The low response rate has limited our ability to provide meaningful numerical analysis of the results. However, the responses provided tended to reflect the views put forward by industry respondents that there were aspects of the methodology they remain dissatisfied with. This feedback is captured in the table below.

Table 2: Issues identified we will consider for future review

| Topic | Comments | Response |

|---|---|---|

| Comparability – return on capital | One industry respondent considered there is potential to set a profit rate that appears generous, but because it falls short of the weighted average cost of capital (WACC) the contract is in effect loss making, when considering returns on capital. | The SSRO’s profit Q&A document considers the matter of different measures of profitability and WACC (question 7). The SSRO has been engaging with OWG on profit principles and this discussion has included consideration of principles relating to returns to investors. The SSRO is engaging further on these. |

| Activity groups – additional activity groups | Two industry respondents suggested the inclusion of Information and Telecommunications companies, which they consider are currently underrepresented. They argued that many single source contracts have substantial work in this area and this should be reflected in the comparator group. | Most MOD single source suppliers are already present in the comparator group. However, the SSRO is open to considering the construction of new activity types, such as Information and Telecommunications, alongside the four existing ones. The SSRO will keep the matter under review, and will consider further work in relation to this as a potential regulatory priority for a future corporate plan. |

| Additional adjustments | Four industry respondents noted that the methodology does not adjust for some accounting and cost issues that they consider are becoming increasing more significant as part of “disallowed” costs. These include: a) imputed interest charges in relation to IFRS 16 Leases; b) selling and marketing costs; and c) amortisation and impairment of intangible assets acquired in a business combination They argued that this results in a distorted comparison which disadvantages contractors who as a result does not receive a ‘fair and reasonable price’. | The SSRO’s profit Q&A document sets out why the methodology does not make adjustments other than for the CSA. Analysing these matters is a significant and complex piece of work. The SSRO will consider further work in relation to this as a potential regulatory priority for a future corporate plan. |

| Value for money | One respondent proposed the need to define the term ‘good value for money’. | The SSRO has been engaging with OWG on profit principles and this discussion has included consideration of principles relating value for money. |

| Incentive fee | One industry respondent proposed a review of the incentive fee, and on how it can be applied to provide more flexibility to reward contractors for better-than-contracted performance across all delivery aspects within a contract. | The incentive adjustment was considered this year as a potential priority under the review of contract profit rates, but there was not sufficient support to prioritise it ahead of other areas. It remains a potential area for a future corporate plan. |

| Comparability – defence representation | One respondent acknowledged that focusing purely on defence companies would bias the outcome to a narrow sample that is not representative of the wider industrial base; others disagreed with the SSRO’s statement that a comparator group based on MOD single source suppliers would be a measure of profit in a non-competitive market on the basis that those suppliers also operate in many other markets, with only a small number having significant volumes of non-competitive work. In general, industry respondents consider that the comparator group contains too many companies that are not similar enough to defence contractors, or that the comparator group should give additional weight to defence companies. | It is not the SSRO’s intention that the comparator groups contain only companies from the defence industry. The MOD’s single source suppliers and the defence industry in general is well represented in the comparator groups. The methodology identifies companies whose economic activities are of the type which contribute in whole or in part to the delivery of QDCs and QSCs, which feedback from this consultation supports as being the case. The result of the process is a robust comparator group that is relevant to the activities which contribute in whole or in part to the delivery of QDCs and QSCs. |

| Comparability – OECD Transfer Pricing Guidelines | One industry respondent disagreed with the way the SSRO applies the OECD’s Transfer Pricing Guidelines and believes its use should be confined to routine transactions, for example commodities. | Transfer pricing is employed extensively by multinational enterprises and tax authorities globally. The OECD’s Transfer pricing guidelines have broad application and we consider them to be appropriate for these purposes. |

| Comparability – geography | Two respondents noted that the majority of MOD’s budget is spent with UK- or US-based companies. They consider comparator companies should reflect where MOD money is being spent and that this is not currently achieved. Another respondent considered the criterion to be too narrow on the basis that a number of other countries that have world class manufacturing capabilities, particularly in aerospace and defence (eg Japan, South Korea, Mexico, etc.) should also be included. | The OECD Transfer pricing guidelines note that “for a number of industries, large regional markets encompassing more than one country may prove to be reasonably homogenous, while for others the differences among domestic markets are very significant”. The SSRO considers Western Europe and North America to be consistent with this guidance. Narrowing the search would exclude a large number of valid comparators. Widening the search would include economies that are economically dislocated from the UK, Western Europe and North America. |

| Comparability – capital structure | One industry respondent suggested that the methodology should consider the comparability of capital structure. They consider the group as a whole is different to defence contractors on the basis that the current baseline profit rate assessment incorporates a Capital servicing adjustment (CSA) nearly twice the median of QDC/QSC contracts. | There is not one particular capital structure applicable to single source contracting and step 6 exists as the mechanism to consider and adjust for any differences. Given the wide range of capital structures present in the defence industry and the operation of step 6, the SSRO does not consider the differences highlighted to be problematic. |

| Comparability – monitoring comparator groups year on year | One respondent suggested that a comparator group that remains unchanged over time might be considered. This would enable consistency year on year to measure the movement of profit in a like-for-like comparison. | The comparator group changes every year due to company specific market dynamics (for example the removal of loss-making companies) although the majority of the group has historically been consistent year-on-year. The SSRO publishes analysis annually (slide 14) to allow consistent year-on-year comparison. |

| Comparability – company hurdle rates | One respondent noted that global companies will choose where to make investment and that lower profit rates make the UK less attractive. They suggested that a better comparison would be against potential returns on offer elsewhere. | The SSRO understands that internal company investment decisions are normally not made public. There are many factors that determine where companies invest money. The comparator group already includes companies operating in a range of jurisdictions and so is not solely dependent on reported UK profits. |

| Activity groups – ‘Develop and make’ and ‘Provide and maintain’ | Two stakeholders suggested altering how the P&M and D&M activity groups are used. One proposed merging the two groups on the grounds that the nature of defence contracting means that it is often difficult to separate them. Another proposed monitoring the level of expenditure MOD makes in each activity type to enable the development of a weighted average rate that better represents the market, rather than the existing simple average. | The SSRO set out the factors it considered in deciding the way in which it combines the D&M and P&M activity types Profit 2017/18 Q&A question 19. We remain of the view the current approach is appropriate and see limited benefit adding additional complexity to this process. |

| Activity groups – ‘Ancillary services’ and ‘Construction’ | Most industry stakeholders queried the continued reporting of the ‘Construction’ and ‘Ancillary Services’ benchmarks. They argued that these activities would be competed or single source by exception because there is a vibrant competitive market for them. | The SSRO considers that these benchmarks provide valuable contextual analysis that supports the BPR recommendation to the Secretary of State. They are not used in the calculation of the baseline profit rate. |

| Activity groups – amending ‘Provide and maintain’ | One respondent considered the P&M activity type does not reflect the fact that single source contracts are for ‘maintain’ and ‘assure a capability’, but do not ‘provide equipment’. | This is already reflected in the P&M characterisation. Companies included in the P&M comparator group are required to ensure availability of an asset either through repair and servicing to third party equipment, or through hire or lease arrangements that include associated upkeep and maintenance. |

| Median Vs Mean | Four industry respondents disagreed with the use of the median, which they believe skews the results towards smaller companies. | The SSRO has published the transparency data on the distortions that would be caused by the use of the mean and weighted mean on its website (slide 33 of supporting analysis). Question 13 of the Q&A explains why the SSRO uses the median rather than the mean or weighted mean and also explains the cause of skewness in the data. |

- From 2 July to 26 August 2019. See SSRO (2019) Single source baseline profit rate methodology: Consultation on changes for the 2020/21 rates assessment ↩

- Comprising the Ministry of Defence (MOD), ADS Group Ltd (ADS) and individual defence contractors. ↩

Single source baseline profit rate, capital servicing rates and funding adjustment methodology – October 2019

Updated 3 October 2019

1. Introduction

1.1 Under the Defence Reform Act 2014 (the Act), the Single Source Regulations Office (SSRO) is required annually to review the figures used to determine the contract profit rate for pricing qualifying defence contracts (QDCs) and qualifying sub-contracts (QSCs). Section 19(2) of the Act requires that, for each financial year, the SSRO must provide the Secretary of State with its assessment of the appropriate baseline profit rate, capital servicing rates for fixed capital and working capital, and the SSRO funding adjustment.

1.2 The baseline profit rate is step 1 of the six-step process set out at section 17(2) of the Act and regulation 11 of the Single Source Contract Regulations 2014 (the Regulations) for determining the contract profit rate for a qualifying defence contract. The Act and Regulations do not set out how the baseline profit rate should be calculated, but the SSRO must aim to ensure that good value for money is obtained in government expenditure on qualifying defence contracts, and that persons (other than the Secretary of State) who are parties to qualifying defence contracts are paid a fair and reasonable price under those contracts.

1.3 The capital servicing rates are used in the determination of the baseline profit rate and as part of step 6 of the six-step process set out in the Act and Regulations for determining the contract profit rate for a qualifying defence contract. The Act and Regulations do not set out how the capital servicing rates should be calculated, but the purpose of step 6 is to adjust the contract profit rate so as to ensure that the contractor receives an appropriate and reasonable return on the fixed and working capital employed by the contractor for the purposes of enabling the contractor to perform the contract.

1.4 The SSRO funding adjustment is step 4 of the six-step process set out in the Act and Regulations for determining the contract profit rate for a qualifying defence contract. The Regulations provide that this adjustment shall be a deduction from the price payable under QDCs and QSCs. The explanatory notes to the Act further set out an expectation that the SSRO will be funded equally by the Secretary of State and Industry. Industry funding is intended to be equitably shared across contractors based upon the value of their QDCs.

1.5 The SSRO’s Guidance on the baseline profit rate and its adjustment explains how parties to a QDC or QSC apply these rates when determining the contract profit rate.

1.6 This document sets out the SSRO’s methodology used to calculate the baseline profit rate, capital servicing rates and SSRO funding adjustment for recommendation to the Secretary of State in January 2020.

1.7 The rates, together with the reasons for any difference to the SSRO’s recommendation, must be published by the Secretary of State in accordance with sections 19(4)-(6) of the Act.

2. Key terms and definition

| Activity characterisation | A written description of the group of economic activities and the relevant boundaries which define an activity type. |

|---|---|

| Activity type | A group of economic activities, defined by the SSRO, which correspond to types of activity that contribute to the delivery of QDCs and QSCs. For example ‘Develop and Make’, ‘Provide and Maintain’, ‘Ancillary Services’ or ‘Construction’. |

| Comparability analysis | Transactions carried out by comparable companies are used as a benchmark. |

| Comparability principle | The aim of the baseline profit rate is to provide the starting point in the determination of the contract profit rate (totalling steps one to six). It is set with reference to the returns of companies whose economic activities are included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs. |

| Comparable company | A company whose economic activities are included, in whole or in part, within an activity type. |

| Comparator group | A group of comparable companies undertaking one or more of the economic activities which make up an activity type. |

| Economic activity | An activity that involves the production, distribution and consumption of goods and services. |

| NACE Rev 2 code | The European Union system of classifying economic activities for the purpose of statistical and other analysis. The SSRO uses NACE codes in conjunction with text search terms to identify comparable companies within the Orbis database. |

| OECD Guidelines | The OECD transfer pricing guidelines for multinational enterprises and tax administrations (2017). This provides guidance on the application of the “arm’s length principle”, which is the international consensus on transfer pricing. |

| Orbis | The database of company-specific information and data supplied by Bureau van Dijk, a Moody’s Analytics company. The SSRO uses this to identify comparable companies and as a source of financial data for those comparable companies for use in the calculation of the baseline profit rate. |

| Text search term | A word or group of words relating to economic activities used to identify comparable companies. For example ‘manufacture’ or ‘production’. The SSRO uses text search terms in conjunction with NACE codes to identify comparable companies within the Orbis database. |

| Underlying profit rate | The median profit level indicator of the comparator group after deducting allowances for the servicing of capital employed. An unadjusted underlying rate can also be calculated using financial data for the comparator companies that is not adjusted for capital servicing. |

3. Baseline profit rate: Key concepts at a glance

4. Approach to the baseline profit rate and capital servicing rates

4.1 This section summarises the approach taken in the SSRO’s methodology for calculating the baseline profit rate (BPR) and capital servicing rates (CSRs).

4.2 In overview, the methodology identifies companies whose economic activities are included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs. These comparable companies form the comparator groups for each activity type.

4.3 The financial data of the comparable companies that form the comparator groups are combined with capital servicing rates derived from relevant bond yields or interest rates to calculate a single underlying profit rate for each activity type. This process is used to calculate four underlying profit rates based on the following activity types:

- Develop and Make (D&M);

- Provide and Maintain (P&M);

- Ancillary Services; and

- Construction.

4.4 Three-year rolling averages of the ‘Develop and Make’ and ‘Provide and Maintain’ underlying profit rates are used as the basis for the composite baseline profit rate that the SSRO recommends to the Secretary of State.

4.5 The methodology adopts a comparable company search process that follows transfer pricing principles to identify comparable companies. The planned lifespan of a comparator group is three years, after which a new search is performed. Annual reviews are undertaken to validate the existing group in the intervening years.

4.6 Transfer pricing is employed extensively by multinational enterprises and tax authorities globally to ensure that companies operating in a number of territories receive appropriate income and profit in each. The UK’s transfer pricing legislation details how transactions between connected parties are handled and, in common with many other countries, is based on the OECD’s internationally-recognised ‘arm’s length principle’, whereby the profit mark-up on transactions between connected entities are benchmarked against comparable transactions between independent entities to ensure that profits are transferred to, and so are taxed in, the appropriate jurisdiction. The OECD’s guidelines and their related expectations and practices are widely known and understood, and their practical implications have been explored.

Box 1: Application of the ‘arm’s length principle’ in taxation

- Determination of years to be covered.

- Broad-based analysis of the taxpayer’s circumstances.

- Understanding the controlled transaction(s) under examination, based in particular on a functional analysis, in order to choose the tested party (where needed), the most appropriate transfer pricing method to the circumstances of the case, the financial indicator to be tested (in the case of a transactional profit method), and to identify the significant comparability factors to be taken into account.

- Review of existing internal comparables, if any.

- Determination of available sources of information on external comparables where such external comparables are needed taking into account their relative reliability.

- Selection of the most appropriate transfer pricing method and, depending on the method, determination of the relevant financial indicator (e.g. determination of the relevant net profit indicator in case of a transactional net margin method).

- Identification of potential comparables: determining the key characteristics to be met by any uncontrolled transaction in order to be regarded as potentially comparable, based on the relevant factors identified in Step 3 and in accordance with the comparability factors set forth at Section D.1 of Chapter 1.

- Determination of and making comparability adjustments where appropriate.

- Interpretation and use of data collected, determination of the arm’s length remuneration.”

OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (2017), paragraph 3.4

4.7 The application of the arm’s length principle in international taxation is analogous to the SSRO’s requirement to recommend a baseline profit rate, which simulates the outcome of a market process (for example a competitive tender). Box 1 sets out an overview of the application of the arm’s length principle as it would apply in the context of international taxation.

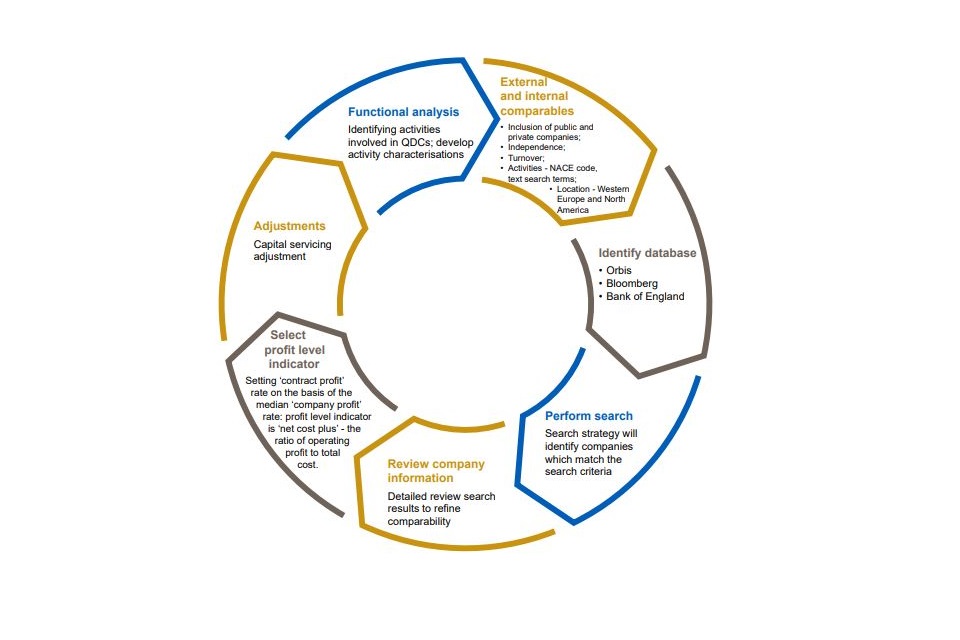

4.8 The principle of the BPR is to ensure that QDC and QSC contractors receive a fair level of profit on contracts, consistent with their functions performed. While this approach is distinct from tax matters, the goal is similar to that of certain transfer pricing methods, which seek to identify an arm’s length profit mark-up by benchmarking returns achieved by comparable companies. Figure 1 illustrates the application of best practice in transfer pricing in the context of the BPR.

4.9 The methodology for calculating the BPR from comparator companies selected using this approach involves:

i. calculating a profit level indicator for each company;

ii. calculating a capital servicing adjustment for each company;

iii. adjusting each company profit level indicator for capital servicing;

iv. removing loss makers in the current year;

v. calculating an underlying profit rate; and

vi. calculating the baseline profit rate.

4.10 The remainder of this document sets out the details relating to the application of each step taken by the SSRO.

Figure 1: Application of best practice approach to transfer pricing

5. Functional analysis

5.1 Steps 3 and 7 in Box 1 are clear that the transactions (or activity) to be tested (in this case QDCs and QSCs) must be understood and the component aspects identified and sought in comparable companies. To do this, the activities to be tested must be characterised.

5.2 In developing these activity characterisations, the SSRO considered the nature of the activities involved in QDCs and QSCs. The SSRO invests time and resources to understand the defence industry as well as the contracts which are reported to it. The organisation does this in a number of different ways:

- It undertakes a regular programme of site visits to defence companies to understand their businesses and the nature of the work involved in QDCs.

- It regularly reviews the MOD’s Defence Contracts Bulletin and the wider defence industry media to identify and understand the type of contracts being awarded.

- It logs queries to the SSRO Support Helpdesk so it can understand the areas where contractors may not be clear about the requirements of the regime and how these apply to individual contracts.

- It provides information on all QDCs to SSRO staff so they can understand at a high level the elements of each contract.

- It attends a range of defence industry events like the DSEI conference, Farnborough Air Show and DPRTE to identify future developments and requirements.

- It has a number of staff who have experience of defence procurement and/or the defence environment. It supplements this through expanding its access to a network of subject matter experts from across the stakeholder community and beyond.

- It speaks with the MOD and industry project teams to understand the complexity involved in defence procurement contracts. 8 It attends training courses delivered by the Defence Academy to understand more about defence procurement.

- It reviews the annual reports and other publicly available information about defence companies to understand past performance, industry health and future priorities.

- It reviews individual company details to confirm whether they are a comparator company in the calculation of the baseline profit rate.

- It learns about each individual contract through the statutory reports it receives and the additional information which is provided by contractors through our engagement with them and their responses to consultations.

- It provides statistical bulletins based on what it learns across contracts on a range of topics, such as pricing methods, and sub-contracting.

5.3 Descriptions of the activities a company is typically expected to undertake to be considered as comparable are at Appendix A.

5.4 These activities are not exclusive to defence contractors. For example, manufacturers of industrial production or agricultural equipment may fall within essentially the same criteria and as such may be considered as potentially comparable manufacturing activities (subject to other considerations such as location).

5.5 The OECD acknowledges that a search focused purely on a product can return limited results, particularly in smaller or niche industries. A broader search also negates potential concerns regarding the influence of government contracting under frameworks, such as the Single Source Contract Regulations themselves, which could be viewed as influencing the results.

5.6 The SSRO has developed these activity characterisations based on the principle that a comparable company is one that undertakes economic activities that are included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs.

6. Identifying external and internal comparables

6.1 Steps 4 to 7 in Box 1 involve identifying companies that undertake comparable economic activities and transact with enterprises on an independent basis.

6.2 ‘External comparables’ are where companies perform comparable activities, but not for the MOD. ‘Internal comparables’ are where companies perform comparable activities for the MOD, perhaps alongside other business with independent parties.

6.3 Internal comparables will have a close relationship to the transactions involved in a QDC or QSC. However, differences are likely to exist between comparable transactions carried out for the MOD and those with an independent third party due to the characteristics of the UK defence market. Therefore, the SSRO’s approach principally relies on the use of external comparables, which are supplemented by internal comparables.

6.4 The company search process has three stages:

i. The first stage applies tailored search criteria to a database of company information (see section 9). This identifies a range of potential external comparator companies that meet a broad set of comparability criteria.

ii. The second stage is a search for potential internal comparator companies, and to identify those companies also found in the first stage that are internal comparator companies (see section 10).

iii. At the third stage, the potential comparator companies found by the two searches are manually reviewed against detailed activity characterisations to deliver the comparator groups (see section 11).

7. Initial selection and ensuring that data is maintained year-on-year

7.1 The potential external comparator companies are initially the result of a full database search carried out in the first year of the multi-year search cycle. Subsequent annual updates pass the prior year’s final comparator groups through the financial search criteria again but there is no new search against the full database until the next cycle begins.

7.2 A full search for external comparator companies is anticipated to be required every three years. However, the SSRO monitors Orbis on a regular basis and may conduct a refresh earlier than planned should it be observed that the comparator groups are no longer sufficiently representative of the population of companies in the database.

7.3 The search for potential internal comparator companies is carried out every year.

7.4 The detailed review against activity characterisations is carried out every year to ensure that companies remain appropriate comparators to the activities in question. Companies that fail to continue to meet the financial or functional criteria will be removed from the comparator group.

8. Identify database

8.1 To identify comparator companies, comparable transactions between independent parties need to be identified. To achieve this, information from a third-party database is used.

8.2 A third-party database serves three functions in this process:

i. Firstly, it provides the functionality to automatically assess a very large pool of companies against a set of tailored search criteria to identify potential external comparator companies.

ii. Secondly, it provides additional information that assists in a detailed manual review against activity characterisations.

iii. Thirdly, it is the source of company financial information used to calculate the underlying profit rates once the comparator groups have been identified.

8.3 The SSRO uses historical reported data of companies as the basis for benchmarking contract profits. A lack of available contract-level data and the unreliability of forecasts means there is no feasible alternative but to use historical company data to benchmark contract profits.

8.4 A range of publicly-available databases exist which can be used to meet these requirements. The Orbis database provided by Bureau Van Dijk is used by the SSRO. Orbis is a comprehensive, global database containing information on over 300 million public and private companies[footnote 1] . ##9. Perform search for potential external comparators

9.1 Comparable companies are identified by applying the financial and functional search criteria described in this section using data in the most recent year and the four years prior to that.

9.2 The use of multiple-year data is recognised by the OECD guidelines to offer additional insight into factors which may (or should) have influenced the transaction being examined. For example, information on changes in size or loss-making may indicate at what stage a company is in its life cycle.

9.3 Financial results reported in other currencies are converted to GBP using the exchange rates reported on Orbis for each year. The exchange rates used on Orbis come by default from the International Monetary Fund (IMF) website and refer to the closing date of the statement.

Data availability

9.4 Companies are required to have data for their most recent year present in Orbis at the time of the company search.

9.5 The SSRO defines a company’s ‘most recent year’ as its financial year ending during the period from 1 April to 31 March inclusive immediately prior to when the company search is performed.

Active companies

9.6 Companies are only included in the search if they are active trading companies and are not dormant.

Legal form

9.7 Companies are only included in the search if they take on one of the following legal forms:

- Public limited company (PLC, AG, SA, SPS, NV, OYJ, ASA, KK, etc.)

- Private limited company (Ltd, GmbH, SARL, SRL, BV, OY, AS, YK, etc)

9.8 LLPs and partnerships are not included in the search as a result of the potentially incomparable nature of their base costs. For example, payments to partners are classified as “partners’ drawings” or distributions rather than operating costs. As such, costs may be understated compared to the costs of companies that pay and recognise salary costs. The results of LLPs or partnerships could therefore distort the benchmarking results.

Independence

9.9 Companies are only included in the search if they are independent. In order to select only companies that are independent at least one of the following is required:

- The company is classified as ‘A’ independent: has known recorded shareholders, none of which having more than 25% of direct or total ownership; or

- The company is classified as ‘B’ independent: has known recorded shareholders, none of which with an ownership percentage (direct, total or calculated total) over 50%, but having one or more shareholders with an ownership percentage above 25%.

9.10 It is important to identify only those companies that are independent and transact solely with third parties rather than related entities.

Consolidated accounts test

9.11 Companies are only included in the search if their accounts do not include intragroup transactions. Consolidated accounts can be considered to give a fair reflection of arm’s length transactions between the group and third parties (subject to the overall independence of the group).

9.12 Unconsolidated group accounts cannot be relied upon as there is no guarantee that any intragroup transactions are conducted on an arm’s length basis. An exception to this is in cases where a company has subsidiaries that are dormant since there will be no related party trading to consider. Companies with both unconsolidated accounts and subsidiaries are therefore rejected.

Geographic location

9.13 Companies located in the following geographic regions are included in the search:

- Western Europe: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, Netherlands, Malta, Norway, Portugal, Spain, Sweden, Switzerland and the UK

- North America: USA and Canada

9.14 A company’s location is determined by the country of its incorporation (i.e. the place where a company is established and formally registered). A company’s place of incorporation is typically, but not always, the location of its head office and management function.

Data Quality and Company Size

9.15 Companies are only included in the search if their financial data is of sufficient quality, determined by if that company is of a size that would normally require an independent financial audit. This requires companies to have data that demonstrates they meet the following criteria for all of the last five years:

- an annual turnover of more than £10.2 million; and either one of the following:

- total assets worth more than £5.1 million; or

- 50 or more employees on average.

Operating profit (EBIT)

9.16 Companies are excluded that report a negative EBIT in all of the five years. This requires companies to have EBIT data for all years subject to this criteria.

9.17 The OECD Guidelines recognise that an independent enterprise would not tolerate losses indefinitely, but that an associated enterprise may remain in business under these circumstances if it was beneficial to the group as a whole. The SSRO’s analysis uses independent enterprises therefore persistent loss-makers are excluded.

Assets and liabilities data

9.18 Companies must have data for tangible fixed assets, current assets, cash and cash equivalents, current liabilities and short-term debt for the most recent two years available in Orbis. This is to enable the calculation of the Capital Servicing Adjustment (section 13).

Tangible fixed assets

9.19 Companies must have a tangible fixed assets value greater than nil for the most recent two years. This is to reflect the expectation that companies performing comparable activities will be required to own or control assets for use in their commercial activities.

Function

9.20 The SSRO’s activity characterisations are written descriptions of economic activities which correspond to types of activity that contribute to the delivery of QDCs and QSCs.

9.21 Assessment against the activity characterisations is too complex to be solely filtered for automatically. The search criteria are broader than the activity characterisations in order to deliver a pool of potential comparator companies that are manually reviewed in detail (section 11).

9.22 Within Orbis, each company is placed within the industry standard classification system Statistical Classification of Economic Activities in the European Community (NACE)[footnote 2]. A company may have more than one NACE code and the search draws on all codes attributed to a company.

9.23 Within Orbis, each company is provided with a brief trade description, primary business line description and full overview description which indicate their business activities. Keywords are searched for within these fields.

9.24 Tables B1, B2, B3 and B4 in Appendix B present the NACE codes and text search terms used in the search strategy for the activity types of ‘Develop and Make’, ‘Provide and Maintain’, ‘Ancillary Services’ and ‘Construction’.

10. Identify potential internal comparators

10.1 Comparable companies are identified by inspecting Ministry of Defence (MOD) supplier lists to ensure that the MOD’s actual suppliers are represented in the comparator groups, where they meet the other criteria.

10.2 The SSRO inspects statistics published by the MOD and uses the SSRO’s Defence Contract Analysis and Reporting System (DefCARS) data to identify potential additional comparators that are not found through the external comparator’s search process (section 9).

10.3 As with external comparators, only companies that are independent and transact solely with third parties rather than related entities are appropriate. Therefore, where relevant, the SSRO identifies the global ultimate owner (GUO) of the contracting company as the potential internal comparator.

10.4 The potential internal comparators must meet the Orbis search criteria described in Section 9, excluding the ‘function’ criteria. This ensures that comparators meet the necessary financial criteria, but are included for consideration irrespective of how their activities are recorded in Orbis.

11. Review company information

11.1 Information on each potential comparator company resulting from the search for both external comparables (section 9) and for internal comparables (section 10) is reviewed in detail to determine if it can be accepted for entry into a comparator group. This involves assessing if the company’s activities are comparable with those set out in the relevant activity characterisation and if it operates in comparable markets. Descriptions of the activities a company is typically expected to undertake to be considered as comparable are at Appendix A.

11.2 The underlying principle is that an ideal comparable company will undertake those activities that are described in the relevant activity characterisation and the market characterisation.

11.3 In order for a company to be accepted into a comparator group, positive evidence is required that it undertakes comparable activities. If the company does not perform comparable activities, or the review is inconclusive, that company must be rejected. In line with the OECD Guidelines this review follows an iterative process, refining comparability at each stage.

11.4 At the first stage, the Orbis ‘main activity’, ‘primary business line’ and ‘main production sites’ are reviewed. This is used as a triage to reject companies that are non-comparable, for example those identified in the D&M activity type search that focused on sales or advertising. At this stage, companies are only rejected where there is strong positive evidence of non-comparability or where main production sites are located outside of comparable markets.

11.5 Companies not rejected at the first stage are then reviewed in greater detail. Orbis is interrogated to establish the company’s activities and where these take place. A broad range of information is examined, such as the location and activities of any subsidiaries and segmental data. Internet searches are carried out to locate information about the company. Typically, this involves examining the company website and, if required, the company reports. Details of the main subsidiaries of the company are also examined where the company is a group or holding company.

11.6 Where positive evidence of comparability or non-comparability can be established the decision to accept or reject the company is made. Where this does not yield sufficient information, or where the website or company reports are not accessible or could not be translated to determine comparability, the company is rejected.

11.7 The activities undertaken by group companies as a whole are considered rather than just those of the holding company. For example, the holding company of an airline is deemed to have an aviation-related function irrespective of the specific activities of the holding company.

11.8 Decisions are subject to a further round of reviews for quality assurance purposes, including examining the presence or otherwise of the MOD’s suppliers. This entire process is supported by independent transfer pricing experts.

11.9 The outcome of the detailed review is a set of comparable companies from which financial indicators are identified to calculate the underlying profit rates.

12. Select profit level indicator

12.1 To determine the underlying profit rate for each activity type, an appropriate profit level indicator (PLI) must be used. A PLI refers to the margin or measure used relative to an appropriate base (for example costs, sales or assets) that is realised from a transaction.

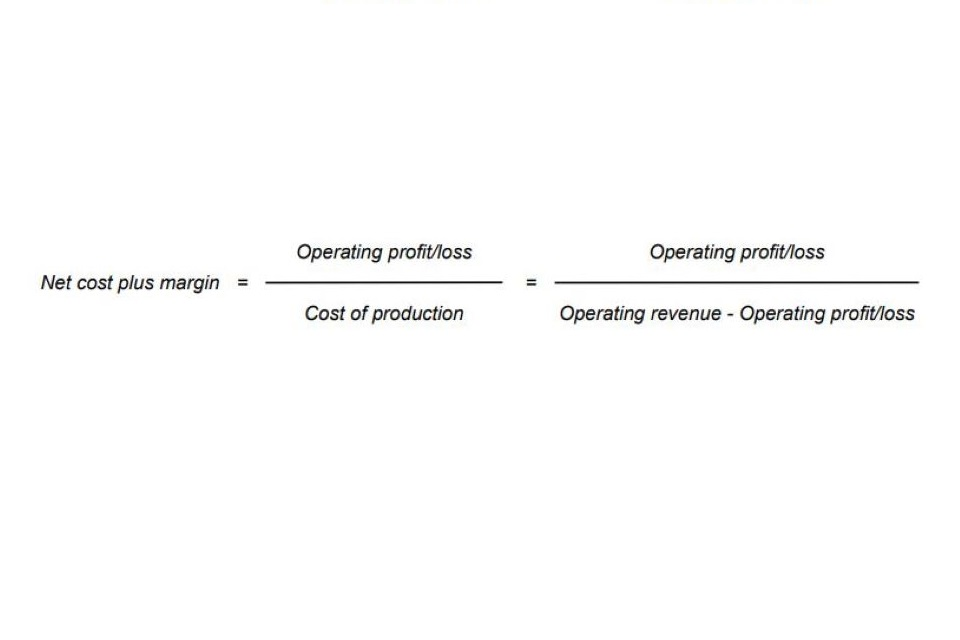

12.2 The net cost plus margin (also known as return on cost of production) is the PLI used by the SSRO. It is the closest equivalent measure of return on Allowable Costs used to determine the contract profit rate of QDCs and QSCs. The SSRO uses earnings before interest and tax (EBIT) as the measure of the return a company makes on its core operations. It excludes the impact of tax, financing structures, and some other income or expenses. EBIT includes depreciation and amortisation which contractors may be reimbursed for through Allowable Costs on a contract-by-contract basis (where these pass the relevant tests). This maintains consistency with the approach to Allowable Costs[footnote 3]

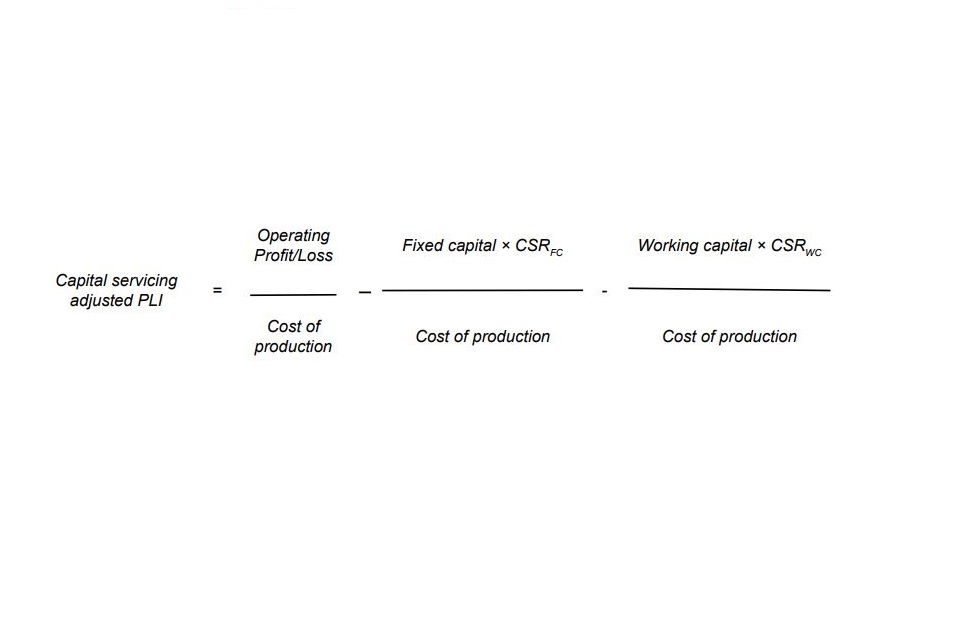

12.3 The PLI is calculated as:

13. Adjustments

13.1 Section 17(2) of the Act, and Regulation 11(7), set out the requirement for the capital servicing adjustment at ‘step 6’: “Take the amount resulting from step 5 and add to or subtract from it an agreed amount (“the capital servicing adjustment”), so as to ensure that the primary contractor receives an appropriate and reasonable return on the fixed and working capital employed by the primary contractor for the purposes of enabling the primary contractor to perform the contract.”

13.2 The PLI of each comparator company is adjusted with respect to capital employed to set a baseline upon which ‘step 6’ can be added. The approach of the SSRO is to adjust the PLI in proportion to the ratio of fixed and working capital employed by each comparator company. This is the reverse of the approach taken at ‘step 6’ in calculating the capital servicing adjustment set out in Guidance on the baseline profit rate and its adjustment.

13.3 The SSRO makes a capital servicing adjustment to take into account the different levels of fixed capital and working capital employed by the companies in the comparator group. This adjustment acts to ameliorate the effects of extreme outliers in the data and is considered by the SSRO to enhance comparability which is consistent with OECD Guidelines.

13.4 The capital servicing adjusted profit level indicator is calculated according to the following:

13.5 CSRFC and CSRWC are the capital serving rates for fixed capital and working capital respectively. The SSRO calculates the capital servicing rates for:

- fixed capital;

- positive working capital; and

- negative working capital.

13.6 The figures for fixed and working capital are the average of the opening and closing balances for the most recent year of the company whose PLI is being adjusted. The definitions of each balance sheet item, the relevant Orbis data fields and a detailed breakdown of the calculation of the capital servicing adjusted PLI is at Appendix C.

13.7 The capital servicing rates that apply at this stage are the same as those recommended to the Secretary of State for application at ‘step 6’ in the calculation of the contract profit rate. This ensures that contractors are not disadvantaged should the aggregate credit rating of the comparator groups differ from their own.

13.8 Bloomberg and the Bank of England are the sources of data for the capital servicing rates.

Fixed capital servicing rate

13.9 The fixed capital servicing rates use the C40515Y Bloomberg index for 15 year BBB rated daily yields of sterling denominated corporate bonds. The time period is seven years up to and including data available at 30 November in the year immediately prior to that in which the rate being calculated applies.

13.10 The ‘Yellow Book’ regime’s methodology used a BBB- credit rating approximated by a BBB interest rate plus an additional 0.5 percentage points applied. To reflect this legacy issue, the 0.5 percentage point adjustment is applied to all data points up to and including 31 December 2014.

13.11 The fixed capital servicing rate is calculated as the mean average of the seven years of daily data.

Positive working capital servicing rate

13.12 The positive working capital servicing rate is calculated using Bloomberg data for one year BBB rated sterling denominated corporate bonds yields (C4051Y index). The time period is three years up to and including data available at 30 November in the year immediately prior to that in which the rate being calculated applies.

13.13 The positive working capital servicing rate is calculated as the mean average of the three years of daily data.

Negative working capital servicing rate

13.14 The negative working capital servicing rate is calculated using Bank of England data on monthly interest for short term deposits (CFMBI32 index)[footnote 4]. The time period is three years up to and including data available at 30 November in the year immediately prior to that in which the rate being calculated applies.

13.15 The negative working capital servicing rate is calculated as the mean average of the three years of monthly data.

14. Calculating the underlying profit rates and composite baseline profit rate

14.1 Companies that made a loss in the most recent year, determined by a negative capital servicing adjusted PLI, are excluded from this calculation. Loss-making companies are removed to reflect the expectation of positive profit on estimated Allowable Costs in QDCs. This maintains consistency with the construct of the profit formula as a mark-up on estimated Allowable Costs and removes the possibility of a negative BPR being produced.

14.2 The underlying profit rate of each activity group for the current year is calculated using the median of comparator company data. The choice of average should reflect the specific characteristics of the data set and the median is a superior measure of central tendency compared to the mean or weighted mean, given the SSRO places no upper limit on the profit level or size of comparator companies.

14.3 The three-year mean averages of the underlying profit rate for the current year and those of the two immediately preceding years are calculated. The SSRO does not reassess previous year’s underlying rates for the current year.

14.4 The mean average of the resulting rates for ‘Develop and Make’ and Provide and Maintain’ is the composite baseline profit rate that the SSRO recommends to the Secretary of State.

The SSRO funding adjustment

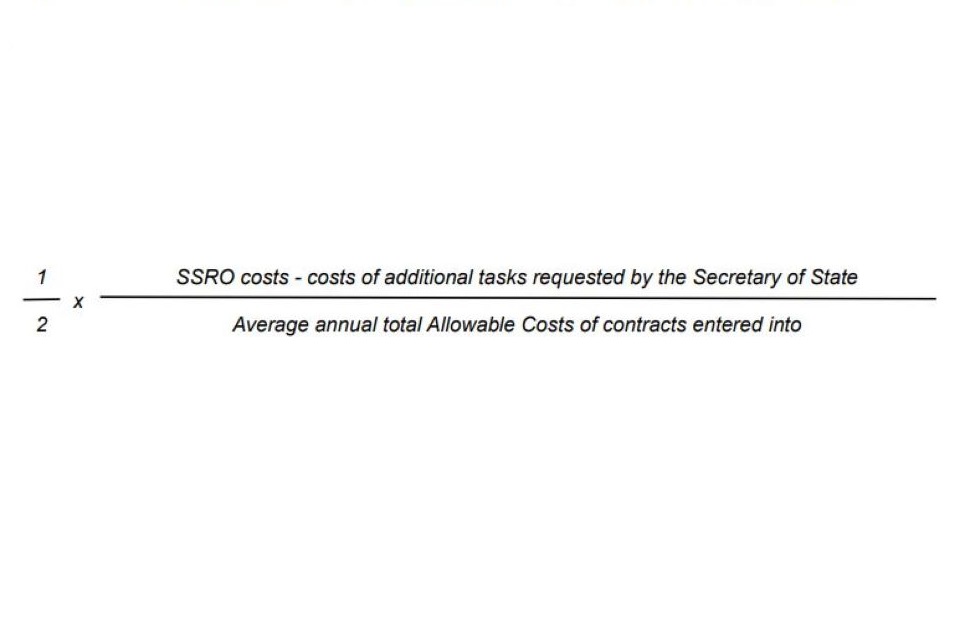

1. The calculation of the SSRO funding adjustment

1.1 The method to calculate the funding adjustment calculation is intended to set it at a level that allows the MOD to recover half of the SSRO’s costs through a reduction in the amounts paid on single source contracts, shared across contractors based upon the value of their QDCs and QSCs.

1.2 The SSRO funding adjustment is calculated as:

1.3 The SSRO’s costs, and the costs of additional tasks requested by the Secretary of State, are the mean averages of the three full financial years preceding the year of the recommendation.

1.4 Where the SSRO’s audited financial information is not yet available for three years, the funding adjustment will be based on the latest years that are available.

1.5 The average annual total Allowable Costs of contracts entered in to will be a mean average of the annual sum of the Total Allowable Costs (including any Risk Contingency Allowance) values reported in latest available report for all QDCs entered in to in each of the three preceding financial years. Where contract amendments are made the most recently reported values will be used but each contract will be included only once in the calculation.

1.6 QDC data will be drawn for the periods which align to that used for SSRO running costs, based on the most recently available published statistics at the time of calculation.

2. Data sources and adjustments

2.1 All SSRO costs, including referrals and one-off items, will be included unless specifically incurred as a result of a request for additional work by the Secretary of State. The partyear costs incurred during the set-up year (2014/15) and costs incurred by the MOD in establishing the SSRO were not included.

2.2 The SSRO costs and the costs of additional tasks requested by the Secretary of State will be drawn from the audited financial statements in the preceding three financial years. The costs are drawn from the Statement of Comprehensive Net Expenditure – Net Expenditure. This means capital expenditure is accounted for via depreciation rather than in cash terms (the SSRO is funded and pays for capital expenditure as it is incurred).

2.3 The QDCs’ data used to calculate the SSRO funding adjustment comes from the latest Quarterly qualifying defence contracts statistics. The total value of QDCs is based on:

- Data for any contract which became a QDC between 1 April and 31 March of a given financial year

- The total Allowable Costs (including any Risk Contingency Allowance) reported in the latest available report as of the date of extraction.

Appendix A – Activity characterisations

1. Market characterisation

1.1 Companies undertaking comparable activities in any activity group are expected to operate in markets that would typically include Western Europe and North America.

1.2 Where a company undertakes global operations consideration should be given to the nature of the activities occurring in different geographic areas. The comparable activities of the business are expected to meet the relevant activity characterisation and be undertaken in comparable geographic areas.

1.3 The determination of where a company’s activities are undertaken might be by reference to the amount of cost incurred, the number of employees, the value of assets employed, or other measures depending on the nature of the activities undertaken.

1.4 It may be acceptable for comparable firms to undertake some activities in non-comparable geographic areas. However, these activities are not expected to extend beyond what might reasonably be required to deliver the company’s principle business.

1.5 The end customers for the outputs generated by comparable companies may be located in any geographic area. For example, a company that exports goods or services from a comparable market to a non-comparable market is unlikely to be excluded on that basis.

2. Develop and make

2.1 Companies undertaking comparable activities considered as ‘Develop and Make’ are expected to engage in manufacturing and the design and development contributing to that process. This would therefore not include manufacturing on behalf of a hiring firm that supplies the design, or those solely undertaking research or design work with no associated manufacturing. Where development activities do not seek to result in a novel or differentiated product the company is less likely to be considered comparable.

2.2 Comparable activities would typically be of the type that can be likened to those involved in producing equipment used for military or defence purposes. This would include scientific or technical research, design, development or testing activities leading to the production of selfcontained sub-systems or finished goods. To the extent that a product is being assembled or constructed then it is likely to represent comparable manufacturing. This could cover a broad range of products such as structural metal goods, machinery, electronic and mechanical subsystems, vessels, containers, general machinery, ships, aircraft, and wheeled or tracked vehicles or other means of transportation and other items of machinery of an industrial nature. If the product is a commoditised unit or processed raw manufacturing input, for example a generic electrical or mechanical components, sheet metal, shaped plastic, ancillary items such as basic tools, then this may not be sufficiently complex and is likely to be excluded. Electronic or mechanical assemblies or subsystems that are complex and not of a commoditised nature are more likely to be considered the output of a comparable manufacturing process.

2.3 The value added, cost base or profits of the business are expected to principally derive from the manufacturing, design and development activities as described above. For example comparable firms would not be expected to derive the majority of their value added through the purchase of raw materials, luxury branding, the exploitation of patents and copyrights or distribution activities. It may be acceptable for comparable firms to engage in some loosely associated activities as part of delivering core comparable business (for example the procurement of inputs and the distribution and marketing of final goods). However these activities are not expected to extend beyond what might reasonably be required to deliver the company’s principal business. Significant involvement in activities that are obviously non-comparable in nature (for example provision of financial services, marketing or food processing) would be cause to reject a company.

2.4 The end customers for the outputs generated by comparable companies are expected to be other businesses, institutions or governments. Comparable companies are not expected to maintain marketing models, sales operations, large networks of product outlets or dealerships aimed at the general public.

3. Provide and maintain

3.1 Companies undertaking comparable activities considered as ‘Provide and Maintain’ are expected to deliver services to ensure the availability of an asset either through repair and servicing to third party equipment, or through hire or lease arrangements that include associated upkeep and maintenance services.

3.2 Comparable activities would typically be of the type which can be likened to those involved in the support and provision of equipment used for military or defence purposes. This could cover a broad range of products such as structural metal goods, machinery, electronic and mechanical subsystems, vessels, containers, general machinery, ships, aircraft, and wheeled or tracked vehicles or other means of transportation and other items of machinery of an industrial nature. Comparable companies may also provide the facilities embodying or integrating the equipment and the training necessary to operate or maintain these assets.

3.3 Repair and servicing activities include arrangements where spares and labour are charged for as they are required, or may include these costs as part of a longer term contracting arrangement. Diagnosis, repair and installation activities would be expected to require an in-depth knowledge of the asset being serviced. This would exclude companies whose capabilities are limited to rudimentary work, such as those involving user-serviceable parts or domestic installations (for example domestic white goods). Hire and leasing arrangements should be focused on items of an industrial or commercial nature.